How are dividends treated in accounting?

Cash or stock dividends distributed to shareholders are not recorded as an expense on a company's income statement. Cash dividends are cash outflows to a company's shareholders and are recorded as a reduction in the cash and retained earnings accounts.

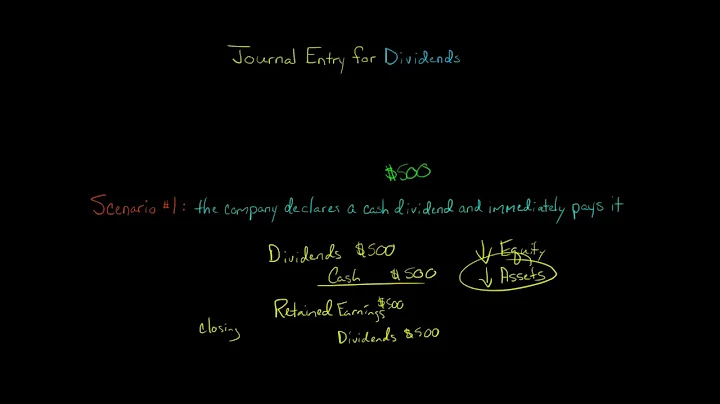

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

If a company pays a dividend by distributing income from current operations, the transaction is recorded as an operating activity on the cash flow statement. On the other hand, if a company pays a dividend from retained earnings, then it is recorded on the balance sheet as both an asset and liability entry.

Cash Dividends on the Balance Sheet

After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. When the dividends are paid, the effect on the balance sheet is a decrease in the company's retained earnings and its cash balance.

Dividends are not reported on the income statement. They would be found in a statement of retained earnings or statement of stockholders' equity once declared and in a statement of cash flows when paid.

The total lamount of dividends paid during a period is shown on the Profit and Loss Statement for that period, since they are paid before the calculation of the Retained Profit.

Cash dividends are paid out of a company's retained earnings, the accumulated profits that are kept rather than distributed to shareholders. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account.

Dividends are not Expenses

When a company pays a dividend it is not considered an expense since it is a payment made to the company's shareholders. This differentiates it from a payment for a service to a third-party vendor, which would be considered a company expense.

- Go to the Company menu and select Make General Journal Entries.

- Select the account from which you will pay the dividend. ...

- Enter the dividend amount as a debit.

- Select the Dividends Payable account and enter the dividend amount as a credit.

Key Takeaways

All dividends paid to shareholders must be included on their gross income, but qualified dividends will get more favorable tax treatment. A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates.

What is the double entry for dividends paid?

If Company X buys shares from Company Y, X becomes the shareholders of Y. So, when dividend is received by X, the double entry is firstly Dr Cash; Cr Dividend (other income), and at the end of year it will be Dr Dividend; Cr Retaining Earnings? 2.

Consolidated Statement of Profit and Loss

The dividend received from the associate is eliminated from the parent's investment income as, if it isn't, then it is effectively being double counted when you recognise the share of associate profit in the CSPL.

Statement of Cash Flows: Dividends paid will appear in the financing activities section of the cash flow statement. Statement of Retained Earnings / Statement of Changes in Equity: This is where dividends are most explicitly noted.

If the company receives dividends from an investment, that is considered dividend income. Any dividend income should be recorded in the operation section as a cash inflow.

Dividends paid out are reported on the statement of cash flows as a use of cash. This is included in the cash flow from financing activities section of the report.

When dividends are paid, the impact on the balance sheet is a decrease in the company's dividends payable and cash balance. As a result, the balance sheet size is reduced. If the company has paid the dividend by year-end then there will be no dividend payable liability listed on the balance sheet.

An interim dividend, like the final dividend, is an appropriation of profits that has to be shown on the debit side of the profit and loss appropriation account.

An accrued dividend—also known as dividends payable—are dividends on a common stock that have been declared by a company but have not yet been paid to shareholders. A company will book its accrued dividends as a balance sheet liability from the declaration date until the dividend is paid to shareholders.

- Cash dividends. These are the most common types of dividends and are paid out by transferring a cash amount to the shareholders. ...

- Stock dividends. ...

- Scrip dividends. ...

- Property dividends. ...

- Liquidating dividends.

The auditor should obtain representation from the management of the entity about the amount retained in unclaimed dividend account by reason of disputes pending in various courts of law and also that it has complied with all laws and regulations applicable to the provisioning and payment of dividend including transfers ...

Why are dividends not considered an expense?

Dividends are not considered an expense, because they are a distribution of a firm's accumulated earnings. For this reason, dividends never appear on an issuing entity's income statement as an expense.

Dividends paid to shareholders also have a normal balance that is a debit entry. Since liabilities, equity (such as common stock), and revenues increase with a credit, their “normal” balance is a credit. Table 1.1 shows the normal balances and increases for each account type.

Dividends are distributions to owners or stockholders. They may be paid in cash, stock, or as dividends in kind. Cash dividends declared are generally reported as a deduction from retained earnings.

Since Distributions are not an Expense, the display of the Distribution account will appear on your Balance Sheet under the Equity section.

Rule 3 of Dividend Rules prescribes the conditions to be complied with for declaring dividend out of reserves. A pertinent question here is – whether a company can declare dividend out of 100% of the amount that has been transferred to General Reserve.