How does the IRS tax table work?

You pay tax as a percentage of your income in layers called tax brackets. As your income goes up, the tax rate on the next layer of income is higher. When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income.

The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Federal income tax rates are progressive: As taxable income increases, it is taxed at higher rates.

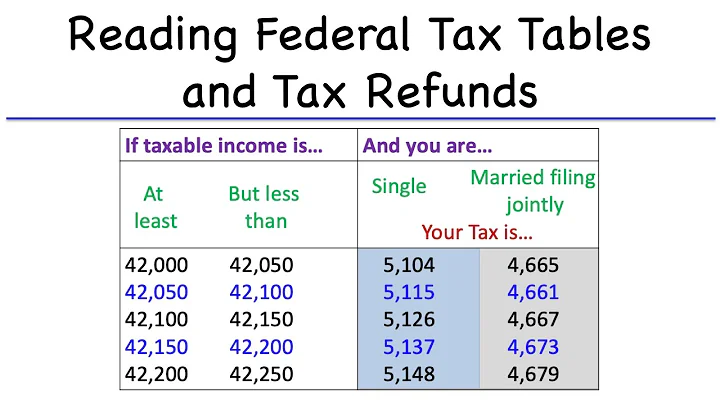

A tax table is a chart that displays the amount of tax due based on income received. The IRS provides tax tables to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. Tax tables are divided by income ranges and filing status.

Basic concepts. The U.S. income tax system imposes a tax based on income on individuals, corporations, estates, and trusts. The tax is taxable income, as defined, times a specified tax rate. This tax may be reduced by credits, some of which may be refunded if they exceed the tax calculated.

Your adjusted gross income (AGI) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement contributions. If you use software to prepare your return, it will automatically calculate your AGI.

Income taxes are collected through withholding (or deducting) money from your paycheck. Employers deduct the money and send it to the government. People who are self-employed, such as entrepreneurs or ride-share drivers, also have to pay income taxes, but those taxes aren't withheld from their earnings.

The term "tax bracket" refers to the income ranges with differing tax rates applied to each range. When figuring out what tax bracket you're in, you look at the highest tax rate applied to the top portion of your taxable income for your filing status.

Tax Tables and Rate Schedules:

Tax tables could be used to present a variety of tax information such as tax brackets and tax deductions. On the other hand, tax rate schedules specify the percentage that should be used to calculate tax liabilities.

The term tax brackets refer to the Internal Revenue Service (IRS) tables, issued each year, that indicate the dollar amount owed in taxes by every taxpayer whose income falls within the minimum to maximum income numbers. Each tax bracket corresponds to a tax rate.

| If taxable income is: | The tax is: |

|---|---|

| Over $82,500 but not over $157,500 | $12,698, plus 24% of the excess over $82,500. |

| Over $157,500 but not over $200,000 | $30,698, plus 32% of the excess over $157,500. |

| Over $200,000 but not over $500,000 | $44,298, plus 35% of the excess over $200,000. |

What percentage of income is taxed?

| State | Single Filer Rates | Married Filing Jointly Rates |

|---|---|---|

| California | 13.30% | 13.30% |

| Colorado (a, o) | 4.40% | 4.40% |

| Connecticut ((i, p, q, r) | 2.00% | 2.00% |

| Connecticut | 4.50% | 4.50% |

Tax brackets and marginal tax rates are based on taxable income, not gross income.

Knowing your federal tax bracket is essential, as it determines your federal income tax rate for the year. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax legislation.

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

Claiming 0 allowances means that too much money will be withheld by the IRS. The allowances you can claim vary from situation to situation. If you are married with a kid, you can claim up to three allowances. If you want a higher tax return, you can claim 0 allowances.

Generally, the IRS won't go rifling through your bank account transactions unless they have a good reason to. Some situations that could trigger deeper scrutiny include: An audit – If you're being audited, especially for issues like unreported income, the IRS may request bank records.

- Bad debts.

- Canceled debt on home.

- Capital losses.

- Donations to charity.

- Gains from sale of your home.

- Gambling losses.

- Home mortgage interest.

- Income, sales, real estate and personal property taxes.

The standard deduction is a specific dollar amount that reduces the amount of taxable income. The standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness. In general, the IRS adjusts the standard deduction each year for inflation.

- Earn immediate tax deductions from your medical plan.

- Defer payment of taxes.

- Claim a work-from-home office tax deduction.

- Analyze whether you qualify for self-employment taxes.

- Deduct taxes through unreimbursed military travel expenses.

- Donate stock.

If you make $60,000 a year living in the region of California, USA, you will be taxed $13,653. That means that your net pay will be $46,347 per year, or $3,862 per month.

Do you get a bigger tax refund if you make less money?

You can increase the amount of your tax refund by decreasing your taxable income and taking advantage of tax credits. Working with a financial advisor and tax professional can help you make the most of deductions and credits you're eligible for.

If you make $80,000 a year living in the region of California, USA, you will be taxed $21,763. That means that your net pay will be $58,237 per year, or $4,853 per month.

If you make <b>$22,000</b> a year living in the region of <b>California</b>, <b>USA</b>, you will be taxed <b> $3,120</b>. That means that your net pay will be <b>$18,880</b> per year, or <b>$1,573</b> per month. Your average tax rate is <b>14.2%</b> and your marginal tax rate is <b>21.7%</b>.

Social Security income can be taxable no matter how old you are. It all depends on whether your total combined income exceeds a certain level set for your filing status. You may have heard that Social Security income is not taxed after age 70; this is false.

If you are 65 or older AND blind, the extra standard deduction is: $3,700 if you are single or filing as head of household. $3,000 per qualifying individual if you are married, filing jointly or separately.