What is the best budget rule for low income?

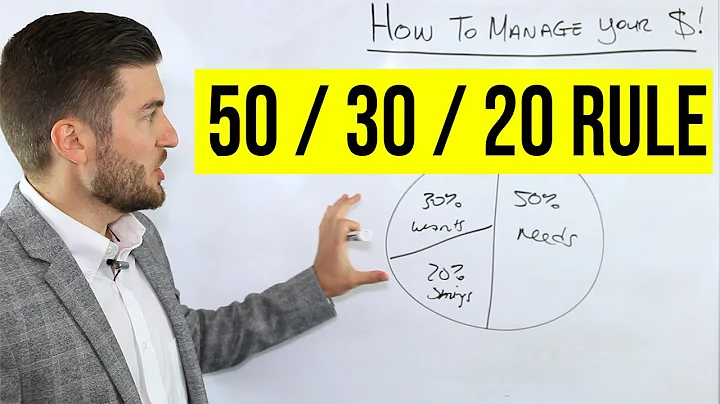

Key Takeaways. The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

This budget follows the same style as the 50/30/20, but the percentages are adjusted to better fit the average American's financial situation. “70/20/10 suggests a framework of 70% of your income on essentials and discretionary spending, 20% on savings and 10% on paying off your debt.

In the 50/20/30 budget, 50% of your net income should go to your needs, 20% should go to savings, and 30% should go to your wants. If you've read the Essentials of Budgeting, you're already familiar with the idea of wants and needs. This budget recommends a specific balance for your spending on wants and needs.

Many financial experts recommend the 50-20-30 rule for low-income families. Spend 50% of your income on food, medical, and housing needs. Use 20% on saving an emergency fund and paying down outstanding debt. Then use 30% for all other expenses.

The golden rule of government spending is a fiscal policy that a government should borrow only to invest, not to fund current spending. In other words, the government should borrow money only to make investments that will produce long-term benefits for the future.

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

For many people, the 50/30/20 rule works extremely well—it provides significant room in your budget for discretionary spending while setting aside income to pay down debt and save. But the exact breakdown between “needs,” “wants” and savings may not be ideal for everyone.

The 30% Rule Is Outdated

Rather than looking at what consumers should be spending on housing, however, the government selected these percentages because that's what consumers were spending.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

Which is something you should not look for in a savings account?

The feature you should NOT look for in a savings account is rewards for using your debit card, as savings accounts are designed to encourage saving money, not spending.

According to the USDA guidelines, you might spend $979 a month on a thrifty plan, $1,028 on a low-cost plan, $1,252 on a moderate-cost plan and $1,604 on a liberal plan. The USDA guidelines can provide a starting point for a food budget, but they don't consider all the variables that can affect cost.

- Sleep on big purchases. If it's not something you need, take a week to think on it. ...

- Never spend more than you have. ...

- Stick to a lower credit card limit. ...

- Budget to zero. ...

- Try a no-spend challenge. ...

- Stop paying for fees. ...

- Plan your meals. ...

- Do your grocery shopping online.

That rule suggests you should spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings and paying off debt. While this may work for some, it's often better to start with a more detailed categorizing of expenses to get a better handle on your spending.

Discretionary expenses are often defined as nonessential spending. This means a business or household is still able to maintain itself even if all discretionary consumer spending stops. Meals at restaurants and entertainment costs are examples of discretionary expenses.

How Do Low-Income Families Spend Their Money? In spite of the safety net, families residing in poverty devote a substantial share of their monthly expenditures to basic shelter, health, and nutrition.

In 2023, the federal poverty level definition of low income for a single-person household is $14,580 annually. Each additional person in the household adds $5,140 to the total. For example, the poverty guideline is $30,000 per year for a family of four.

- Food assistance.

- Housing help.

- Help with utility bills.

- Benefit finder.

- Welfare (TANF)

- Health insurance.

- Social Security.

- State social service agencies.

The 50/30/20 rule is a budgeting technique that involves dividing your money into three primary categories based on your after-tax income (i.e., your take-home pay): 50% to needs, 30% to wants and 20% to savings and debt payments.

- Know where your money is going.

- Pay yourself first.

- Automate everything you can.

- Don't carry a balance.

What is the golden rule the best rule?

The “Golden Rule”—“Love your neighbor as yourself”—is doubtless the most widely known and affirmed ethical principle worldwide.

Living on $2,000 per month is doable, but you won't be able to live just anywhere. This is important because at the time of writing the average Social Security benefit paid is $1,701 per month.

- Tip #1: Don't wait. ...

- Tip #2: Pay close attention to your budget. ...

- Tip #3: Increase your income. ...

- Tip #4: Start an emergency fund – even if it's just pennies. ...

- Tip #5: Be patient.

It's enough for a couple of years, but not long term. If you already owned your basics, and could share rental/utility costs, you would be fine, but if you suddenly needed a new refrigerator, or worse, a car, you'd be hurting.

Zero-based budgeting (ZBB) is a budgeting technique in which all expenses must be justified for a new period or year starting from zero, versus starting with the previous budget and adjusting it as needed.